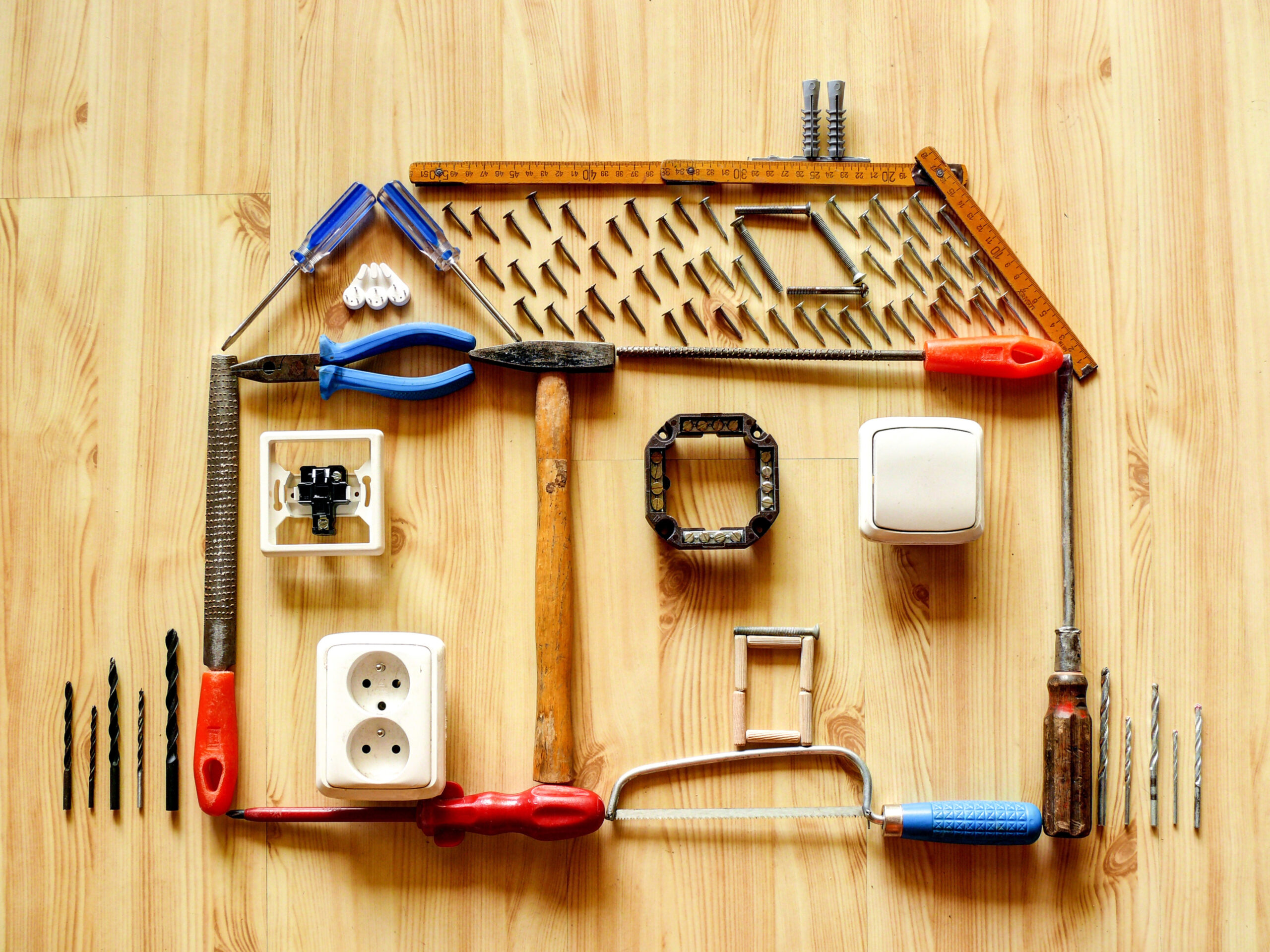

Fix your home without breaking your wallet

Absolutely! You just need to determine the financing strategy that makes the most sense for your situation. Options include:

- Cash

- Credit Union or bank financing through your home improvement dealer

- Mortgage refinance

- Home Equity Line of Credit (HELOC)

- Home Equity Fixed Rate Loan

- Credit Card

Here are some things to consider about each payment method:

Cash. If you have it, this is a good way to go because you don’t pay interest on borrowed money. However, if you have to reduce your savings significantly, or if you’re dipping into your “emergency fund” for a non-emergency, you may want to reconsider. When interest rates on borrowed money are low, you’re better off saving your cash for real emergencies and borrowing money at a low rate. You don’t want to find yourself having to pay for an emergency with a high-interest credit card.

Financing from a financial institution, via your home improvement dealer. This is a good solution because those who qualify can get great rates and quick service, depending on the lender. Washington Energy Services often arranges financing through credit unions such as Salal Credit Union, so customers get great rates, terrific service and quick responses to applications. Plus, customers become members of the credit union and can take advantage of all their products and services.

Mortgage refinance. When rates on mortgage loans are low, it can be a perfect time to refinance. You can save hundreds, even thousands, in interest over the life of a loan, plus you can lower your monthly payment or shorten the term of your loan! The extra cash in your pocket is a great way to finance that new, energy-efficient siding or an environmentally friendly tankless water heater.

HELOC. A home equity line of credit allows you to borrow against the equity you already have in your home, and the loan may even be tax deductible, though you’ll need to consult your tax advisor on deductibility. With a HELOC, you can borrow up to a high percentage of your home’s equity, but you only pay interest on the money you borrow. This is a great alternative if you’re not yet sure how much money you’ll need for the projects you’ve planned.

Credit Card. Of all your options, your credit card is probably the most expensive, due to usually higher interest rates. If you can pay off the balance on your card within your grace period, you’ll escape the finance charges and possibly earn some rewards, depending on the card you use. However, if it will take several months or more to pay off the costs of your project, some of the other options will likely cost less in the long run.

Courtesy of Salal Credit Union, SalalCU.org

Related products

Suggested Reading

- 2016

- AC

- AC Installation

- AC Units

- AFUE

- air conditioing

- air conditioner

- air conditioning

- air conditioning maintenance

- air conditioning service

- air conditioning tune-up

- air duct

- air duct cleaning

- air handlers

- air pollution

- Air Purification System

- air purifier

- Air Sealing

- angie's list

- award

- basement Finishing

- Bathroom remodel

- BBB

- BBB Accredited Business

- before and after

- Best air conditioner

- best filters

- best generator

- best locks

- best water heater

- best window install

- boilers

- bryant

- Bryant AC

- bryant furnace

- bryant heat pump

- christmas lights

- clean air

- clothes drive

- Clothes For Kids

- coat drive

- combi-boiler

- comfort

- community

- Construction

- contractor

- contractors

- Cooling

- Cooling equipment

- Coronavirus Protection

- custom

- daikin

- deals

- discounts

- DIY

- Donation

- Donations

- door hardware

- door installation

- door replacement

- Door Transformations

- doors

- drafty home

- drain cleaning

- Duct Cleaning

- Duct Cleaning Services

- ductless

- Ductless heat pump

- ductless heat pump. mini-split

- Ductless heat pumps

- ductless heating system

- ductless heating systems

- ductless installation

- Ducts

- earth day

- eco friendly

- EER

- election

- electrical inspection

- emergency

- energy

- energy conservation

- energy efficiency

- energy efficiency rebates

- energy efficient AC

- energy efficient air conditioner

- energy efficient home

- energy efficient hvac

- energy efficient HVAC Systems

- energy efficient windows

- energy myths

- energy saving

- energy saving home products

- energy star

- energy tax credit

- environmentally friendly

- exterior doors

- fall

- fall weather

- fiber cement

- fiberglass doors

- filter

- filter change

- financing options

- fireplace

- fireplace insert

- fireplace repair

- fireplace tune-up

- front door

- furnace

- furnace filters

- furnace install

- furnace maintenance

- furnace mileage

- furnace problems

- furnace replacement

- furnace service

- furnaces

- Garage door replacement

- gas fireplace

- gas fireplace inserts

- Gas Fireplace Makeover

- gas furnace

- generators

- going green

- good business practices

- green solutions

- Guardian Maintenance Club

- heat

- heat pump

- heat pump installation

- heat pump maintenance

- heat pump vs ac

- Heat Pumps

- heat pumps maintenance

- heat wave

- Heating

- Heating and Cooling equipment

- heating and cooling systems

- Heating Brands

- Heating Control

- Heating equipment

- Heating System Tuneup

- heatwave

- HEPA filter

- history

- holiday

- home

- home buyer

- home energy

- home energy efficiency

- Home energy efficiency solutions

- home exterior

- home heating

- home improvement

- Home Improvement Rebates

- home improvement repair

- home inspection

- home maintenance

- home maintenance checklist

- home maintence

- home performance

- home protection

- home repair

- home safety

- home upgrade trends

- home upgrades

- home value

- homeowners

- honeywell

- hot water

- hot water heater

- houzz

- how to

- HVAC

- HVAC Contractor

- HVAC Contractors

- hvac system

- IAQ

- indoor air quality

- infographic

- install

- install furnace

- insulation

- intellihot

- interior doors

- kids

- Kitchen face lift

- LED light

- LED lights

- light bulb

- light bulbs

- locks

- mailbag

- maintenance

- march

- membership

- mini-split

- modulating furnace

- money saving

- money savings

- navien

- new door installation

- new home

- New homeowner

- new windows

- news

- pacific northwest weather

- patio doors

- pets

- plumbing

- plumbing inspection

- power

- power outages

- precision tune up

- preventative

- Pro Tips

- Programmable Thermostat

- Programmable Thermostats

- propane

- PSE Award

- PSE Energy

- PUD

- Q & A

- Ratings

- rebates

- refund

- REME Halo

- Remodel

- remodeling hacks

- Replacing Heating System

- reputation

- Safe Home Insulation

- sale

- save energy

- Saving money

- scam

- scams

- seattle

- Seattle Weather

- SEER

- service

- services

- Siding

- Siding replacement

- sliding glass doors

- Smart Home

- Smart thermostat

- smoke

- Solar Attic Fan

- solar power

- Solar Powered Light Strand

- sound

- spring

- standby generators

- storm doors

- summer

- summer fires

- Summer heat

- Summer home

- super service 2016

- tank water heater

- Tank water heaters

- tankless tune ups

- tankless water heater

- tankless water heaters

- tax rebate

- thanksgiving

- Thermostat

- tips

- trends

- tune-up

- upgrade

- upgrade cooling

- upgrade heating

- utilities

- utility rebates

- veterans

- Washington Energy

- washington energy services

- water conservation

- Water Heater

- water heater installation

- water heater maintenance

- water heater repair

- water heaters

- water leak protection

- Wildfire Season

- wildfire smoke

- window

- window energy efficiency

- window install

- window maintence

- window remodel

- window repair

- window replacement

- windows

- winner

- winter

- zone heating

- Air Conditioning

- Air Purifiers

- Cooling

- Doors

- Ductless heat pump

- Environmental

- Fireplace

- Furnace

- Gas fireplace

- Generators

- Heat pump

- Heating

- Home improvement

- How to

- HVAC

- Indoor Air Quality

- Insulation

- News

- Plumbing

- Rebates

- Seattle

- Siding

- Smart Home

- Tank water heaters

- Tankless water heaters

- Tips to save money

- Uncategorized

- Wildfire Season

- Windows